The Cost of Benefits

How Frédéric Bastiat refutes the unsuccessful Biden legal strategy on student-loan forgiveness

By Thomas Berry

On June 30, the Supreme Court rejected the Biden administration’s attempt to use a 20-year-old statute to enact a sweeping, nationwide loan-forgiveness program. The core of the Court’s analysis rested on the plain meaning of the text of the statute, in this case the Higher Education Relief Opportunities for Students Act of 2003. Specifically, the Court held that the law’s grant of power to the executive to “waive or modify” provisions of federal law in emergencies did not authorize it to completely rewrite laws to create a new federal loan-forgiveness program.

In addition to analyzing this plain text, the Court also invoked the “Major Questions Doctrine.” This judicial interpretive principle holds that sweeping grants of power will not be lightly assumed in the absence of a clear congressional statement bestowing such authority. The Court explicitly held for the first time that the Major Questions Doctrine applies to “benefits programs” like loan forgiveness just as much as it applies to regulatory programs like vaccine mandates. In so holding, the Court correctly recognized a key economic principle: Since every government “benefit” produces losers as well as winners, the power to grant a “benefit” can be just as dangerous as the power to enact a regulation.

In the past few years, the Supreme Court has invoked the Major Questions Doctrine to stay or invalidate three executive actions that were based on novel and expansive readings of long-standing laws: the Occupational Safety and Health Administration’s “vaccine or test” mandate, the Centers for Disease Control and Prevention’s eviction moratorium and the Environmental Protection Agency’s greenhouse-gas-emission restrictions. Each of these actions regulated certain parties and restricted their liberty in some way, specifically by imposing mandates on employers, restrictions on landlords or emission caps on power plants, respectively.

Attempting to distinguish student-loan forgiveness from each of these programs, the Biden administration argued that the Major Questions Doctrine should be limited to regulatory programs only, not benefits programs like student-loan forgiveness. In its brief to the Supreme Court, the administration emphasized that the student-loans case did not “involve any assertion of ‘regulatory authority,’ but rather the exercise of authority over a government benefit program to provide additional relief to beneficiaries.”

In support of this theory, the administration quoted a concurring opinion by Justice Neil Gorsuch in the Environmental Protection Agency case, which emphasized the “serious threat to individual liberty” that can come with “the power to make new laws regulating private conduct.” The administration argued that the “provision of government benefits, in contrast, poses no similar risk of ‘significant encroachment into the lives’ of individuals and the affairs of entities.” The Department of Education was “not claiming power to impose regulation on private parties,” they said, but rather claiming authority to provide loan forgiveness as a benefit. For that reason, the administration argued that the Court did not have “the same ‘reason to hesitate’” before accepting the government’s statutory interpretation.

But the Supreme Court firmly rejected this proposed distinction. In his opinion for a six-justice majority, including Justice Gorsuch, Chief Justice John Roberts wrote that the Supreme Court “has never drawn the line the [Education] Secretary suggests—and for good reason.” The government had argued that benefits programs do not pose the same threat to individual liberty as do regulations, but Chief Justice Roberts explained that both types of programs involve “consequential tradeoffs.” Any benefits provided to some portion of society must ultimately be funded or subsidized by another portion of society. The decision to impose such a monetary burden can be just as consequential as the decision to impose a regulatory burden, which is why “control of the purse” is “among Congress’s most important authorities.”

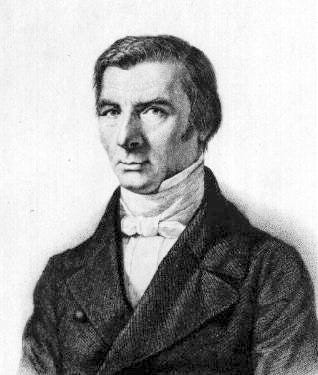

Indeed, the argument that “benefits” do not pose a threat to personal liberty exemplifies an economic fallacy identified over 150 years ago by French economist Frédéric Bastiat. In his 1850 essay “That Which Is Seen and That Which Is Not Seen,” Bastiat provided several examples of government policies whose benefits are immediate and easily seen but whose costs come later and are thus more hidden. As Bastiat wrote, recognizing the “unseen” future costs of a policy “constitutes the whole difference” between “a good and a bad economist.” Bastiat likened a government that ignores long-term costs to a person who “gives way to fatal habits” such as laziness or overspending, only to reap the consequences later.

Bastiat’s most famous and enduring example of unseen costs is the parable of the broken window, which centers around a careless child who accidentally breaks a shop window. Those focused on immediate benefits would argue that the child has helped the economy by creating more business for the glazier, who is paid six francs to repair the window. But as Bastiat explained, the shopkeeper “would have employed his six francs” in some other way if not for the broken window, such as replacing his old shoes or adding another book to his library. It is the loss of six francs to the shoemaker or bookseller’s trade as a result of the broken window that goes unseen.

Another of Bastiat’s examples was taxation, where the “advantages which officials advocate are those which are seen” but “the disadvantages which the taxpayers have to [suffer] are those which are not seen.” Spending taxpayers’ money on a new government building is easily seen, but the loss of what taxpayers would have spent their money on is less easily seen. As Bastiat vividly described, “I want to agree with a drainer to make a trench in my field for a hundred sous. Just as we have concluded our arrangement, the tax-gatherer comes, takes my hundred sous, and sends them to the Minister of the Interior.” Although the government boasts of a new project or benefit, “the field undrained, and the drainer deprived of his job, is that which is not seen.”

Just so in the case of student-loan forgiveness. As my Cato Institute colleague Neal McCluskey has calculated, the loan-forgiveness plan likely would have cost taxpayers around $427 billion, which is more than 36 times the annual budget of the Head Start program and two and a half times the annual budget of the U.S. Army. The benefits of the potential program would have been easily seen, but the inevitable cost to taxpayers less so. Because such losses often manifest in goods not purchased or economic advances not made, the harms may have been less immediately evident. But that makes them no less real.

Fortunately, the Supreme Court recognized this fallacy. During oral argument, Solicitor General Elizabeth Prelogar insisted that “it’s perfectly logical for Congress to broadly empower the executive to provide benefits.” That might be true if benefits did not need to be paid for. But if that were true, who would ever object to benefits? Prelogar claimed that benefits don’t involve a “corresponding tradeoff on individual liberty interests,” but that should come as a surprise to most taxpayers. Prelogar’s argument, if accepted, could have led to even more unilateral policymaking power accumulating in the executive branch. By closing the door on this argument, the Court ensured that decisions to impose significant monetary burdens on taxpayers will instead remain with Congress, as designed by the Framers in our Constitution.