Inflation Is Painful, But the Fed Shouldn’t Overreact

By David Beckworth and Patrick Horan

For the past several months, Americans have felt the pain of higher inflation as they spend more on items ranging from food to gasoline to used cars to housing. Many observers wonder whether the inflation is being caused by the Federal Reserve keeping interest rates low and buying up lots of government debt or by supply chain disruptions and other production bottlenecks caused by the COVID-19 pandemic. If it’s the former, then the Fed will need to tighten monetary policy to get inflation under control. If it’s the latter, though, the recent uptick in prices will dissipate on its own.

Inflation Indices

Unfortunately, it’s very difficult to distinguish between the two phenomena in real time, and different inflation measures can send different signals. There are two major inflation indices, the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) Price Index. Each index has two ways of looking at inflation—“headline” inflation, which includes volatile food and energy prices, and “core inflation,” which does not include those categories. Economists tend to prefer the core measures because food and energy are frequently affected by short-term supply-side factors such as shortages. The Fed prefers to use core PCE in assessing whether monetary policy needs to be loosened or tightened to achieve its target of 2% inflation on average over time.

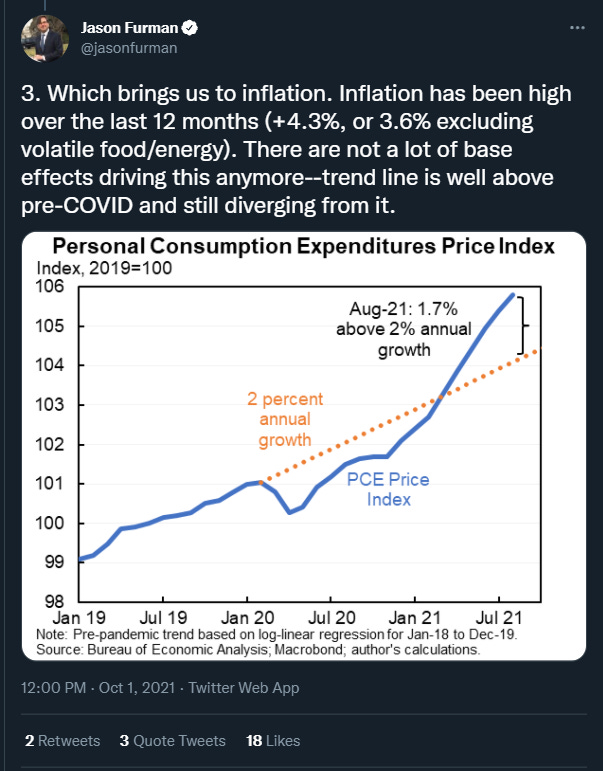

The latest month for which we have inflation data is August. Year-over-year headline and core CPI rose 5.3% and 4.0%, respectively. However, both numbers were lower than the numbers for the previous month. Year-over-year headline and core PCE rose 4.3% and 3.6%, respectively. Headline PCE increased slightly more than the previous month, while the rate of inflation for core PCE remained the same. Even if inflation may be showing signs of slowing, Harvard professor and former Obama administration economist Jason Furman observes that prices are now well above their pre-pandemic trend line.

Does this mean it’s time to tighten monetary policy? The Fed recently gave hints that the answer is yes. In September, Chair Jerome Powell announced that the Fed is prepared to taper or scale back its long-term bond purchases later this year and possibly raise its target interest rate as early as next year, assuming the economy continues to recover.

But if the present inflation is due to transitory supply shocks rather than Fed policy, then the Fed should be careful not to tighten prematurely, which could choke economic recovery. This is not a purely theoretical concern: In the summer of 2008, the Fed was hesitant to cut its target interest rate—which would have made it easier to borrow money and stimulated economic growth—out of a mistaken concern for higher inflation. But the greater threat at that time was financial instability and a contracting economy, which could have been mitigated had the Fed cut its rate sooner. Even more egregiously, the European Central Bank, fearing inflation, raised its target interest rate in 2008 and then again in 2010 and 2011 as it drove the Eurozone into crisis. In both cases, the central banks were misled by inflation caused by supply shocks and responded inappropriately.

Checking the Forecasts

When in doubt over whether inflation is driven by Fed policy or external forces, it is helpful to look at medium-term forecasts for inflation. The figure below shows one popular example: the five-year, five-year-forward inflation forecast that comes from the Survey of Professional Forecasters. This is a five-year forecast of the average inflation rate, beginning five years in the future. For example, the current forecast is for the average inflation rate from 2026 to 2031.

This horizon is useful since it allows us to see beyond the near term, where supply chain disruptions due to the pandemic are affecting inflation. Inflation forecasts this far out, in other words, should be largely reflecting the stance of monetary policy without interference from short-term changes. The figure below shows that the professional forecasters’ outlook for inflation is very close to 2%. They see the Fed keeping inflation anchored over the medium to long term.

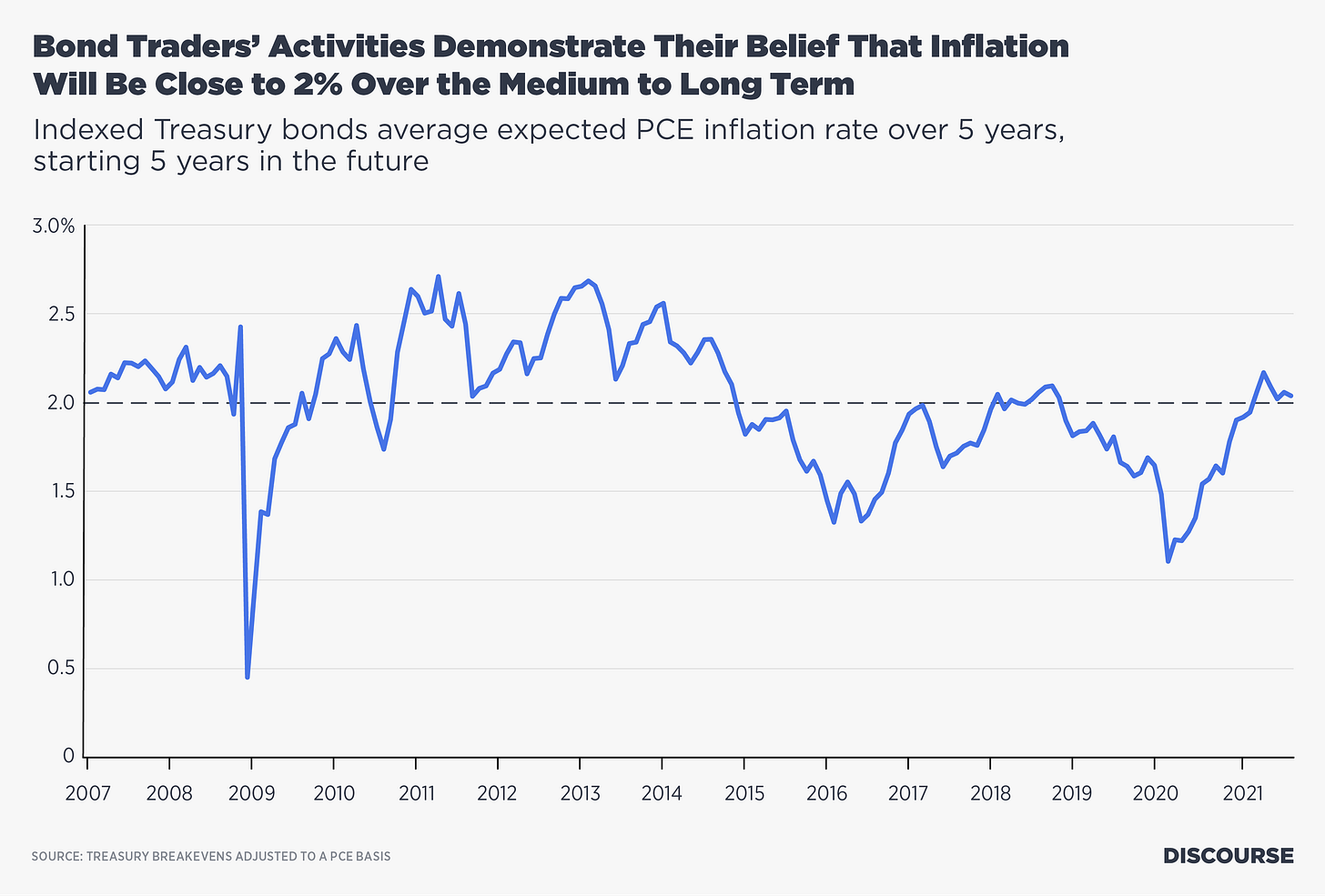

The next figure shows another five-year, five-year-forward inflation rate. This measure comes from the bond market and is based on Treasury bonds indexed for inflation. This forecast, unlike the previous one, comes from the interaction of all bond traders around the world. These individuals have skin in the game since they are trying to be profitable in their trades. Consequently, this forecast provides a nice cross-check on the one from the Survey of Professional Forecasters. The figure below demonstrates that here too the forecast is now close to 2%, indicating that bond traders also believe the Fed is committed to keeping inflation near its target over the medium term.

Forecasts over the medium term, then, show that the Fed’s current performance is about right, but that could change depending on how events play out over the next year. If the economic recovery continues to be strong and puts additional upward pressure on inflation, then it might make sense for the Fed to pump the brakes on inflation by tightening its monetary policy. However, if other factors such as the pandemic and supply chain bottlenecks continue to stymie economic activity, then the Fed shouldn’t be too quick to raise interest rates.

For now, the Fed has signaled it will begin slowly reducing bond purchases near the end of this year. The Fed has also indicated it is likely to start incrementally raising interest rates next year if the economic recovery continues. This gradual approach to tightening monetary policy is sensible given the current state of recovery. Therefore, if lawmakers want to address the high prices caused by inflation, rather than blaming the Fed, they should work on ameliorating bottlenecks and shortages.