The China Challenge: Risks to the U.S. Economy if China Invades Taiwan in Seven Charts

Open-source intelligence data reveal strategic 'points of interest' for Beijing

By Christine McDaniel and Weifeng Zhong

The trade and economic effects of a Chinese invasion of Taiwan could easily exceed those of Russia’s invasion of Ukraine. China’s economy is 10 times larger than Russia’s, and Taiwan’s is four times larger than Ukraine’s. U.S. businesses and consumers rely much more heavily on China and Taiwan for key intermediate inputs and final goods. Given Taiwan’s outsized role in the global advanced semiconductor chip industry—92% of the world’s most advanced chips that power our smart devices are made in Taiwan—any disruption would leave most advanced U.S. tech companies such as Apple, Amazon and Google, and the U.S. economy at large, in the lurch. Two immediate and direct risks to the U.S. economy in the event of a geopolitical incident in the Taiwan Strait are container shipments for international trade and submarine cables for global digital flows. Ocean routes for the transport of goods in container ships are easy to adjust. But the undersea cable network for digital flows is less conspicuous. Hundreds of thousands of miles of cable line the ocean floor, connecting to land-based stations with power and networking infrastructure to facilitate reliable intercontinental communications. Nearly all digital and internet traffic relies on submarine cables. If a cable is cut or a landing station is damaged—intentionally or not—the flow of that data will be interrupted. In a recent policy brief, we present new evidence from the open-source intelligence entity New Kite Data Labs that sheds light on locations, or “points of interest” (POIs), in Taiwan that may be strategic priorities for China economically or militarily (or both). The data include 294,100 POIs in Taiwan with detailed information such as coordinates. The POIs include 183 military locations, 341 transportation locations, 2,397 government sites and 550 information and communication technology (ICT) infrastructure locations, including undersea cable landing stations. This evidence may indicate the kind of documentation China’s military is gathering on Taiwan. A series of graphics below illustrates the serious, concrete risks to U.S. goods and digital trade with and through Taiwan in the event of a crisis in the strait.

The Long Way: Sea Route Density (2021)

The Taiwan Strait can be avoided easily enough, but steering entirely clear of Taiwan or the South China Sea could add hefty costs to a big chunk of global trade.

The Taiwan Strait (Route 1 in the above map) is a key waterway that gives passage to 88% of the world’s largest ships by tonnage. There are a few alternatives in the event of a disruption in the Taiwan Strait. One option is to go around the island, Route 2, which analysts and ship owners say would add about half a day to voyages. Some cargo vessels and oil tankers were rerouting that way in August, during China’s military drills, to avoid confrontation. If going around the island is not possible, heading south through Indonesia (Route 3) is another alternative, but it would add $515.8 million in monthly shipping costs. If confrontation were expanded even more, ships could be forced to sail all the way around the southern coast of Australia (Route 4), which would add an estimated $2.8 billion per month.

Backbone of the Global Internet: Submarine Cable Network (2021)

Taiwan is a hub for the physical wires that undergird the virtual world.

It’s common to think that data in our digital age are “in the cloud,” but the transmission of nearly all data is carried through the ocean floor by undersea cables, as shown in the map above. Among them, trans-Pacific cables have prospered in the last 20 years. The United States now is connected to about 60 undersea cables, and about a third go to Asia.

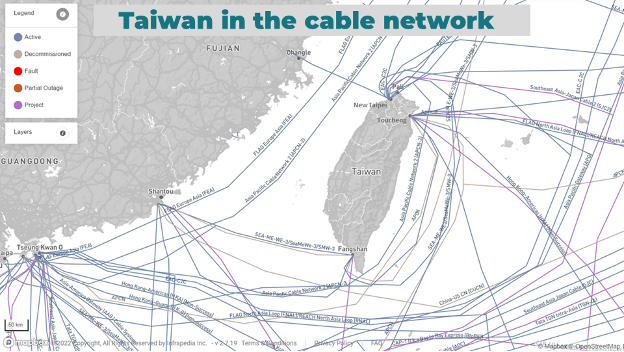

Taiwan in the Undersea Cable Network

Data flowing to, from and through Taiwan are focused on just three chokepoints.

Source: Infrapedia (website), accessed August 10, 2022, https://www.infrapedia.com/app. Taiwan is connected to about 15 submarine cables, which come to shore at landing stations in just three areas, as shown on the above map: the city of New Taipei, the northern town of Toucheng and the southern town of Fangshan. These landing stations connect high-capacity cables in which U.S. tech companies have made significant investments. For instance, the Pacific Light Cable Network, owned by Google and Meta, became ready for service this year with landing points in Toucheng, Taiwan; Baler, Philippines; and El Segundo, California. While some of these cables may be digitally protected through advanced encryption, the physical security around cables and their landing stations is sorely lacking. That’s a vulnerability in the event of a kinetic conflict.

POI data curated and left unguarded by a malicious Chinese entity suggests that locations in Taiwan of economic and military importance may be targets of China’s intelligence collection. The data include 550 ICT facilities on the island, such as cable landing stations and satellite earth stations, shown in the above map. They include two unspecified “Huawei devices,” with little detail about the actual type of device.

As shown in the above map, the POIs also include 341 transportation facilities, such as airports, seaports, train stations and vessels. Disruptions to these facilities would put significant pressures on Taiwan and global supply chains.

Another category, shown above, is the 183 military points of interest, ranging from army headquarters to brigades, ammunition depots and airbases.

The dataset includes 2,397 government and political offices at all levels in Taiwan, shown in the above map. Examples range from Taiwan’s National Security Bureau and its Ministry of Foreign Affairs at the national level to the township offices on two small islands off the main island of Taiwan. The bedrock of the internet is the submarine cables lining the ocean floor, and new evidence reveals points of interest for China, which include economic centers, potential military locations and submarine cable landing stations. This evidence portends a heightened risk to U.S. goods trade and digital flows with and through Taiwan, should there be a crisis in the Taiwan Strait. U.S. officials can help build up the resiliency of supply chains by working with allies in the Indo-Pacific to improve security for submarine cables and their landing stations. Contingency planning for container shipping traffic and essential intermediate inputs to U.S. production and value chains should also be part of this cross-Pacific cooperation.