A Pictorial Guide to Congress’ Irresponsible Health and Budget Proposals

The proposed legislation adds substantially to runaway federal spending that is already outpacing U.S. economic output

By Charles Blahous

Congressional leaders and the Biden administration are currently embroiled in intensive negotiations over major spending legislation they hope to enact this fall. Central to these efforts is the so-called Build Back Better plan, advertised as a whopping $3.5 trillion spending package but likely costing even more: The Committee for a Responsible Federal Budget estimates the true total to be over $5 trillion.

The draft budget reflecting these ambitions, which is already moving through committee and headed to the House floor, would massively increase spending in several areas, including refundable tax credits, energy spending, education subsidies and healthcare. The proposed spending blowout is problematic in general, but the health benefit proposals in particular—including further expansions of Medicare, Medicaid and so-called Obamacare—represent a major escalation of the fiscal irresponsibility lawmakers have practiced for the past several years. Americans should hope that negotiators go back to the drawing board and rethink the entire approach.

Visual images can often convey situations more effectively than textual descriptions. So, rather than presenting this conclusion as a rhetorical argument, I will present a series of pictures to show the problematic nature of these proposals by placing them in the context of federal finances. The story told by these visuals is threefold:

Skyrocketing federal debt is driven by government spending growth.

This spending growth is driven by federal health and retirement programs.

The proposals currently before Congress would significantly worsen the situation.

Where We Are Now: The Budget Context

The following graphs present historical federal budget data from 2000 to the present, along with the Congressional Budget Office’s current projections through 2030. All numbers are presented as a percentage of U.S. GDP, to distinguish budget trends that could be sustainable from those that must be corrected because they are outstripping growth in our economic output. I would have preferred to extend the projections through 2040 to show long-term trends more starkly, but CBO doesn’t currently provide up-to-date annual projections in all budget categories that extend that far. The figures shown here take into account the American Rescue Package (ARP) passed in early 2021. Anything still to be enacted through budget reconciliation would be overlaid on these numbers.

As shown in Figure 1 (above), federal indebtedness was essentially stable during the George W. Bush years and even declined slightly relative to GDP in 2005-2007. But debt rose dramatically during the Great Recession, both because of the recession itself and because of new federal spending to fight it. However, after the economy recovered, lawmakers failed to normalize the debt situation, continuing to float elevated debt throughout the Obama and Trump administrations. There followed another dramatic debt surge during the pandemic, and this debt is projected to grow further out of control even if this year’s budget reconciliation legislation doesn’t add to the problem.

As Figure 2 (above) shows, the biggest debt surges were due primarily to spending bursts in response to the Great Recession and the COVID-19 pandemic. However, a closer look at the trendlines shows that spending is growing persistently faster than our economic output (as measured by GDP), even setting aside the two temporary surges in anti-recession spending. Federal lawmakers are progressively losing control of the budget. Why is this happening?

First, let’s explain what is not happening. This is not a problem of inadequate taxation, as Figure 3 (below) shows.

Figure 3 shows that federal tax collections tend to grow slightly faster than GDP over time. Of course, there are occasional tax cuts and other revenue declines, with the most pronounced dip on this graph occurring in the early years of the Obama administration. But tax collections tend to fluctuate closely around historical averages, even with intermittent changes to tax law. For all the political attention paid to taxes, tax policy has little to do with the structural fiscal problem. In fact, federal taxes are projected to exceed historical averages as a share of GDP throughout the upcoming decade. Tax collections would actually exceed historical averages in 2021 despite the pandemic, were it not for the ARP enacted earlier this year.

A notion widely propagated on social media—that the only thing preventing the federal government from delivering a better quality of life to its citizens is that billionaires and corporations aren’t being taxed similarly to historical norms—is a fiction. Its purpose is much like those of other popular fictions: to nurture a sense of grievance that can be exploited for political gain, or to obscure unpalatable truths. The unpalatable truth here is that federal spending is simply growing faster than we can afford.

Now let’s look at spending areas that are not causing the problem. It turns out that large categories of the federal budget—indeed, all annual appropriations including defense and non-defense domestic discretionary spending, as well as mandatory spending on military and civilian retirement programs and veterans’ benefits—have mostly shrunk relative to GDP and to historic norms. For readers who are unfamiliar with the nomenclature, annually appropriated discretionary spending is different from mandatory spending, such as that for federal health programs or Social Security. All mandatory spending is automatically authorized to continue each year absent a change in law. There have been occasional surges in domestic discretionary spending in response to recent recessions, but for the most part, the discretionary and mandatory categories shown in Figure 4 (below) are not driving the problem.

Nor is the worsening problem driven by non-health income security programs. As Figure 5 (below) shows, there have been massive increases in income security spending during recent recessions, especially during the current pandemic. But thus far, these spending measures are largely temporary. Unless they are perpetuated in the budget bill, they aren’t significant drivers of the fiscal situation currently spiraling out of control.

The fiscal situation is not imploding because of non-health welfare programs, tax policy, defense spending or other appropriated spending. What is the problem, then, and how would it be made worse by the budget proposals before Congress?

A significant part of the spending growth is in Social Security. As Figure 6 (below) demonstrates, Social Security spending has been growing faster than the nation’s economic output, largely as a result of automatic annual benefit increases enacted in the 1970s and a failure to adequately adjust eligibility ages for an aging population. Lawmakers have not fixed the situation, which will drive Social Security into insolvency if not corrected soon. Social Security has been running cash deficits since 2010 and has contributed increasingly to federal deficits ever since.

While Social Security growth remains a major unsolved problem, the proposed budget outline would not directly exacerbate it. Rather, the most problematic effects of the proposed budget would come from its changes to federal health programs.

Medicare Provisions in the Proposed Budget Outline

To understand the problems with the budget’s health policy proposals, we must first understand current trends in federal health programs. Figure 7 below illustrates how the growth of major federal health programs (Medicare, Medicaid/CHIP and the Affordable Care Act “Obamacare” subsidies) far exceeds what the federal budget can support. Figure 7 compares the growth of these programs to the concurrent growth of average annual federal deficits (the averages are taken over a period of seven years). Growth in major federal health program spending accounts for all growth in average federal deficits (with occasional temporary exceptions, such as when recessions have prompted a one-time boost in other federal spending).

The share of national health spending that should be financed by federal taxpayers is a value judgment with no objectively correct answer. However, irrespective of one’s answer to that question, current federal health policy is clearly untenable. Lawmakers cannot promise ever-increasing federal health benefits that perpetually grow faster than the nation’s capacity to finance them. At some point federal spending must be constrained to grow no faster than the national economic output that must support it.

In practical terms, the current trend must stop far sooner than that because no population will tolerate its discretionary income perpetually shrinking to support lawmakers’ addiction to promising bigger health benefits. Uncontrolled federal health spending growth has many other adverse consequences as well, including fueling healthcare price inflation and crowding out access to vital healthcare services.

The largest federal health program is Medicare, which the budget proposes to expand. Medicare is financed from two trust funds: a Hospital Insurance (HI) trust fund, which is funded mostly by worker payroll tax contributions, and a Supplementary Medical Insurance (SMI) trust fund, which finances physician and outpatient services (Part B) and prescription drug benefits (Part D). SMI receives roughly three-quarters of its funding from general government funds and the other one-quarter from premiums assessed on beneficiaries. As Figure 8 (below) shows, net Medicare spending is rising much faster than national economic output.

Because Medicare HI program cost growth is outstripping revenue growth, its trust fund is projected to be insolvent in 2026 (see Figure 9 below) and thereafter will be able to meet only 91% of its scheduled benefit payments. Lawmakers must act, either to slow the growth of HI spending or to increase HI taxes, to prevent a sudden interruption in Medicare’s hospital benefits. The last time we came this close to Medicare HI insolvency, in 1997, a Democratic president worked with a Republican Congress to slow the HI program’s cost growth and maintain its solvency. Nothing in the current budget proposal suggests that today’s lawmakers have a comparable plan for meeting this important responsibility.

To the contrary, the budget framework would make the situation worse by creating new Medicare benefits, even though Medicare cannot meet its currently projected obligations. Specifically, dental, hearing and vision benefits would be added to Medicare and financed from Medicare’s SMI trust fund. This placement within Medicare SMI makes sense, because dental, hearing and vision services have more in common with the other physician (Part B) services financed from SMI than they do with the hospital services financed from HI.

There are arguments for and against Medicare providing dental, hearing and vision benefits, and the purpose of this article is not to settle that argument. However, there is a responsible way to add these benefits and an irresponsible way. Those who propose the benefits should recognize that they have costs and should responsibly finance those costs in a manner consistent with Medicare financing principles. If lawmakers are unwilling to take the responsible path, they should not add the benefits at all.

The following background information is critical to understanding the situation. Medicare participants pay premiums that finance 25% of Part B spending, with the government providing the other 75%. These premiums are automatically indexed by law so that they remain 25% of Part B spending each year. Whereas so many other attempts to contain Medicare cost growth—including the ACA’s Cadillac Plan tax, the Independent Payment Advisory Board and a host of well-meaning bipartisan commissions—have been repealed or otherwise failed, Medicare’s premium indexing is one of the few mechanisms that has actually worked. For one thing, it has remained on the books since 1997, and for another—because 25% of the pain of any program cost increases is felt by premium-paying beneficiaries—the provision acts as a brake on any irresponsible worsening of Medicare SMI’s cost growth problem. Lawmakers are still a long way from stabilizing the growth of Medicare costs, but without the premium-indexation mechanism, the situation would be far worse.

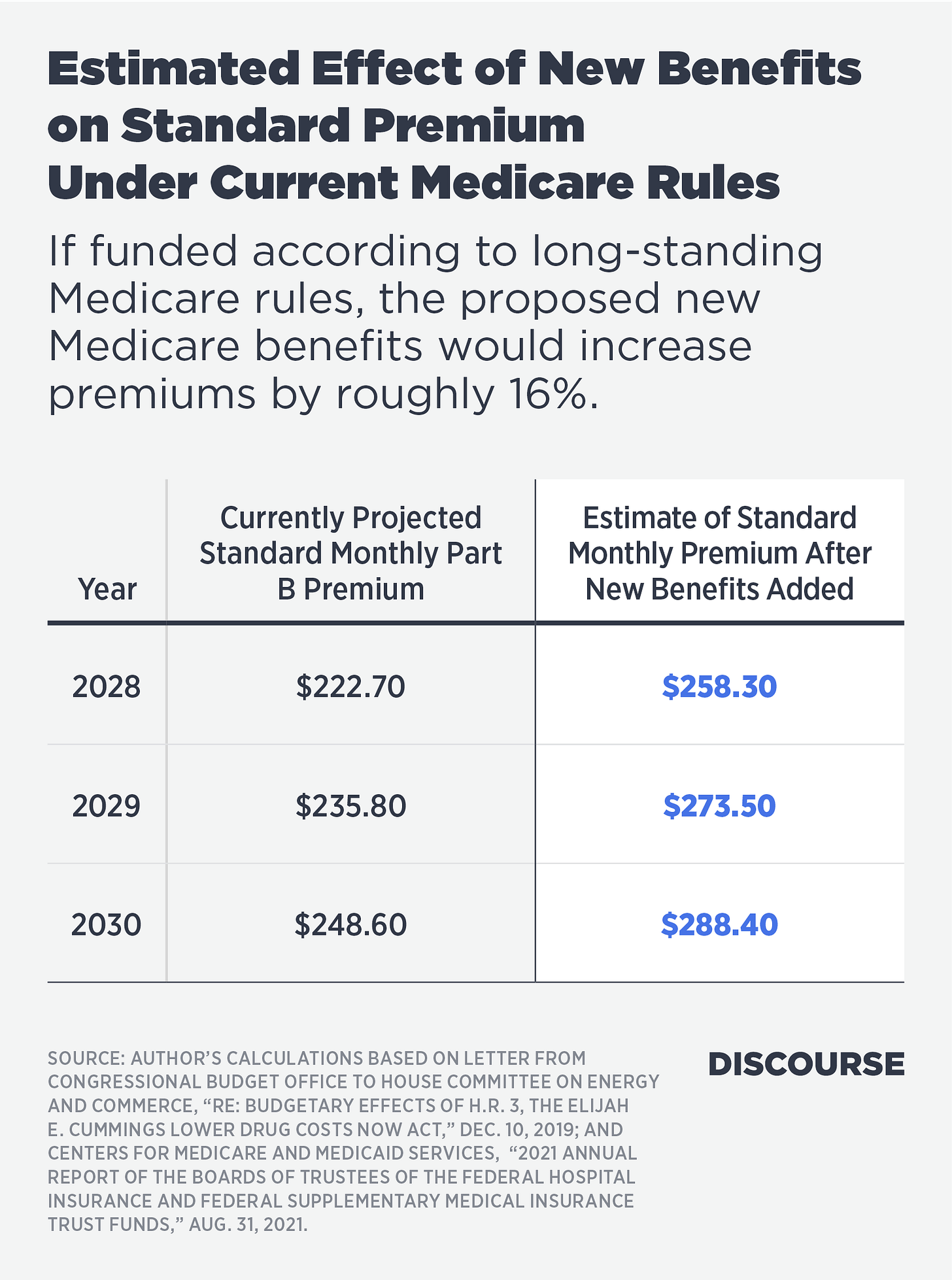

If lawmakers add dental, hearing and vision benefits to Medicare SMI, this will increase program costs and therefore participant premiums, unless lawmakers employ a gimmick to evade Medicare’s long-standing financing design. Based on CBO estimates of the cost of previously introduced legislation, I estimate that providing these new benefits by 2028, including them with Part B, and slowly phasing in beneficiary cost-sharing responsibilities (as in the current legislative draft) would increase premiums by an average of about 16% relative to what they would otherwise be. Table 1 (below) provides an annual estimate of the effects of a 16% increase in premiums through 2030, the latest year for which we have trustees’ projections.

The premium increases estimated in the table would cover 25% of the new benefit costs; lawmakers would still need to find a way to finance the other 75%. Current Social Security law also contains a provision preventing a Part B premium increase from being fully assessed if it exceeds the amount of the Social Security cost-of-living adjustment. That provision would need to be waived to permit the costs of the new benefit to be proportionally distributed between taxpayers and beneficiaries.

However, the legislation moving through the House makes an irresponsible alternative choice: simply decreeing that the costs of the new benefits “shall not be taken into account” when calculating premiums. The draft legislation also stipulates that the new benefits package—unlike the rest of Medicare Part B—will be funded via an open tap on general government revenues.

I estimate that if this gimmick is employed, Part B premiums will no longer cover 25% of relevant program costs, but less than 22%. This irresponsible change would undermine Medicare SMI’s long-standing financing design, dismantling the financial protection provided to Medicare by premium indexing throughout the past quarter-century. Further, if this gimmick is employed for new Medicare benefits, it can and will eventually be employed for other Medicare costs as well.

In sum, the proposed budget wouldn’t add dental, vision and hearing benefits to existing Medicare, a program with a long-standing design of assessing premiums based on costs. Instead, this budget would create a new package of health benefits inconsistent with Medicare’s underlying design and simply call it Medicare. Indeed, the budget would begin to dismantle existing Medicare financing to authorize new unfunded dental, vision and hearing benefits. That is a large and highly problematic difference with past expansions of Medicare’s benefits package, such as the addition of prescription drugs enacted in 2003.

Doubling Down on Problems in Medicaid and Obamacare

The budget also proposes to create a new federal Medicaid program for low-income individuals whose states of residence opted not to expand Medicaid under the ACA. Essential things to know here are that (1) Medicaid is a joint federal and state program, (2) its costs have been rising faster than can be sustained (see Figure 10 below), (3) the ACA further expanded Medicaid but the Supreme Court rendered the expansion optional for states, and (4) most but not all states opted for expansion. Before the ACA, Medicaid mostly covered individuals who were below the poverty line or physically vulnerable (pregnant women, children and medically needy individuals). The ACA allowed states to cover childless adults with incomes up to 138% of the poverty line and provided an inflated federal match rate for this coverage (90% of the funding as opposed to the previous average of 57%).

The ACA’s Medicaid expansion has been beset by problems and inequities. Whereas Social Security is mostly a well-designed program whose costs are simply growing too fast, Medicaid is poorly designed in addition to its costs growing too fast. This observation applies to the basic design of Medicaid but even more to the ACA’s Medicaid expansion. The root of the problem is that states make coverage decisions and manage the program while the federal government picks up most of the costs, undermining states’ incentives to act as careful stewards of taxpayer dollars.

The ACA reduced these incentives by paying even higher match rates (90% versus the previous average of 57%) for the expansion population than for Medicaid’s previously eligible population. Brian Blase has documented how the inflated match rates have stimulated dramatic increases in improper payments, with an estimated annual cost of over $100 billion. Enormous cost overruns have resulted. For example, the latest Medicaid actuarial report shows annual costs per expansion enrollee of $6,874 in 2021, more than 48% higher than the $4,620 projected just four years earlier.

Expansion adults are actually costing Medicaid more per capita than other non-disabled, non-aged adults are, something that shouldn’t be happening given that Medicaid’s previously eligible population is in worse economic and physical health than the expansion population. The data powerfully suggest problems of improper payments, participant misclassifications and a general failure to police costs under the ACA—all phenomena that follow from the federal government’s paying states far more to cover Medicaid’s expansion population than the states received for previous coverage.

There is no policy justification for paying states more to cover able-bodied, childless adults with incomes above the poverty line than to cover pregnant women and children in poverty. The only reason this is happening is that the federal government is attempting to induce states to pursue health policies they would never adopt if states were allocating their own budget resources. A better policy would be to equalize federal support for all Medicaid beneficiaries and enact broader reforms to stabilize the growth of Medicaid costs. The budget outline instead worsens the Medicaid policy situation in both respects—adding to Medicaid’s cost growth and perpetuating the inequities in federal matching support.

The budget also proposes to expand subsidies for ACA health marketplace plans, specifically making permanent the “temporary” expansion enacted with the ARP earlier this year. This is a bait-and-switch: The massive expansion of ACA subsidies in early 2021 was enacted as part of legislation supposedly targeted at providing economic relief from the COVID pandemic. But now lawmakers are proposing to make it permanent.

Brian Blase, Sally Pipes and Doug Badger have each written insightfully about problems with the ARP’s expansion of the ACA. Blase calculated that the benefits of the latest expansion flow disproportionately to higher-income households, in addition to fueling healthcare cost growth for everyone else. For example, he calculated that a family of four with income of $212,000—ineligible for subsidies before this year—would actually become permanently eligible for $12,340 in subsidy support, courtesy of the U.S. taxpayer.

To argue that these subsidy expansions will be fully paid for with tax increases misses the point. They are bad policy even if offset with tax increases because they would pour fuel on the fire of runaway health spending growth, which is already accumulating at an unsustainable rate (see Figure 7). Tax increases merely postpone the necessary corrections to spending growth rather than actually making those corrections. Lawmakers should address the explosion in federal health spending commitments before devising still more ways to spend money that the federal government does not have.

The author thanks Brian Blase, Doug Badger, Keith Hennessey, Elise Amez-Droz, Christina Behe and David Masci for helpful comments and edits on earlier drafts of this article.